Insure - Funeral

FUNERAL COVER

Honouring your loved ones with dignity.

Saying goodbye to someone is a difficult and emotional moment, and the last thing you want to worry about is the financial well-being of your loved ones. Rest assured, you are protected, and your final farewell will be managed with the utmost dignity and respect.

Plan

Empowering you to make thoughtful and secure arrangements for your final journey.

Protect

Ensuring that you and your loved ones are protected when it matters most.

Provide

Providing support to you and your family when they need it most.

Plan

Empowering you to make thoughtful and secure arrangements for your final journey.

Protect

Ensuring that you and your loved ones are protected when it matters most.

Provide

Providing support to you and your family when they need it most.

WHY ASUER FUNERAL COVER

Get up to R100 000 cover with a policy that is flexible, simple and transparent.

Our benefits are designed with you in mind.

24 Hour Pay Out

We pay out claims within 24 hours once we have been provided with the correct documentation.

Read more

Premium Holiday

Policyholders are entitled to take a 1-month premium holiday every year, after the policy has been active for 12 consecutive months.

Read more

Child Dependants Covered at No Additional Cost

Children aged 0 to 18 of the primary insured are eligible for R10 000 cover at no additional cost, provided they are specified at the start of the policy or added at a later stage, prior to any claims being made.

Read more

Life Stage Benefits

Birth Premium Waiver

Birth Premium Waiver

- We offer 3 months premium waiver on your entire policy after the birth of your child.

Read more

- We offer 3 months premium waiver on your entire policy after the birth of your child.

Marriage Premium Waiver

Marriage Premium Waiver

- We offer 3 months premium waiver on your entire policy after you get married.

Read more

- We offer 3 months premium waiver on your entire policy after you get married.

Death Premium Waiver

Death Premium Waiver

- We offer 6 months premium waiver on remaining insured lives after the death of the Policyholder.

Read more

- We offer 6 months premium waiver on remaining insured lives after the death of the Policyholder.

Shorter Waiting Period for Natural Death & Waiver

The waiting period for all lives on the policy is 5 months. There is no waiting period on accidental death.

Read more

Voluntary Policy

Pause

Policyholders can pause premium payments for up to 3 months at a time, with a 6-month total limit, suspending all coverage during the pause.

Read more

Premium & Benefit

Escalation Rates

Premiums and benefits will increase by 5% annually, but the Policyholder can choose to keep the current terms unchanged.

Read more

24 Hour Pay Out

We pay out claims within 24 hours once we have been provided with the correct documentation.

Read more

Premium Holiday

Policyholders are entitled to take a 1-month premium holiday every year, after the policy has been active for 12 consecutive months.

Read more

Child Dependants Covered at No Additional Cost

Children aged 0 to 18 of the primary insured are eligible for R10 000 cover at no additional cost, provided they are specified at the start of the policy or added at a later stage, prior to any claims being made.

Read more

Life Stage Benefits

Birth Premium

Birth Premium

Waiver

- We offer 3 months premium waiver on your entire policy after the birth of your child.

Read more

- We offer 3 months premium waiver on your entire policy after the birth of your child.

Marriage

Marriage

Premium Waiver

- We offer 3 months premium waiver on your entire policy after you get married.

Read more

- We offer 3 months premium waiver on your entire policy after you get married.

Death Premium

Death Premium

Waiver

- We offer 6 months premium waiver on remaining insured lives after the death of the Policyholder.

Read more

- We offer 6 months premium waiver on remaining insured lives after the death of the Policyholder.

Shorter Waiting Period for Natural Death & Waiver

The waiting period for all lives on the policy is 5 months. There is no waiting period on accidental death.

Read more

Voluntary Policy

Pause

Policyholders can pause premium payments for up to 3 months at a time, with a 6-month total limit, suspending all coverage during the pause.

Read more

Premium & Benefit

Escalation Rates

Premiums and benefits will increase by 5% annually, but the Policyholder can choose to keep the current terms unchanged.

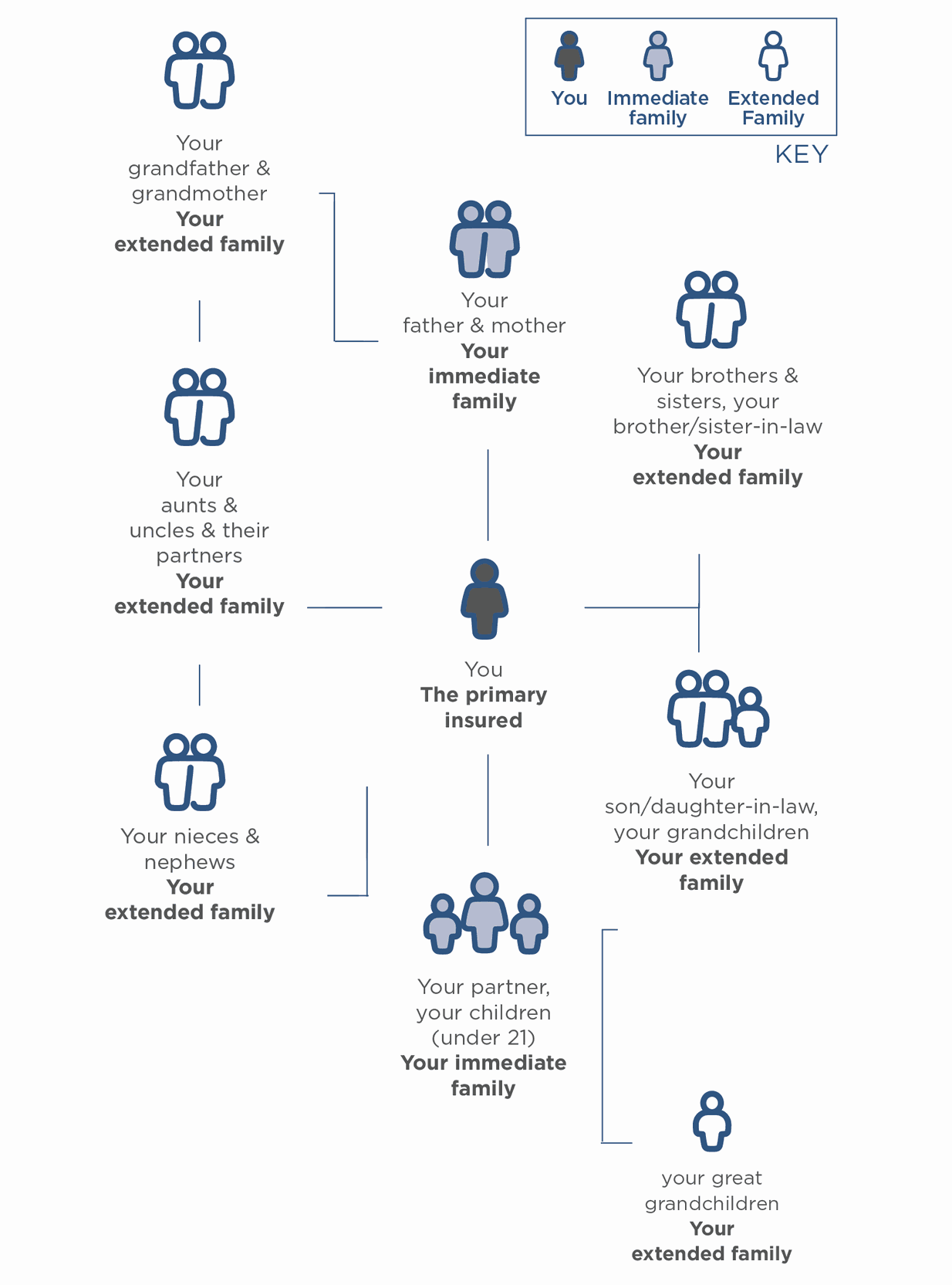

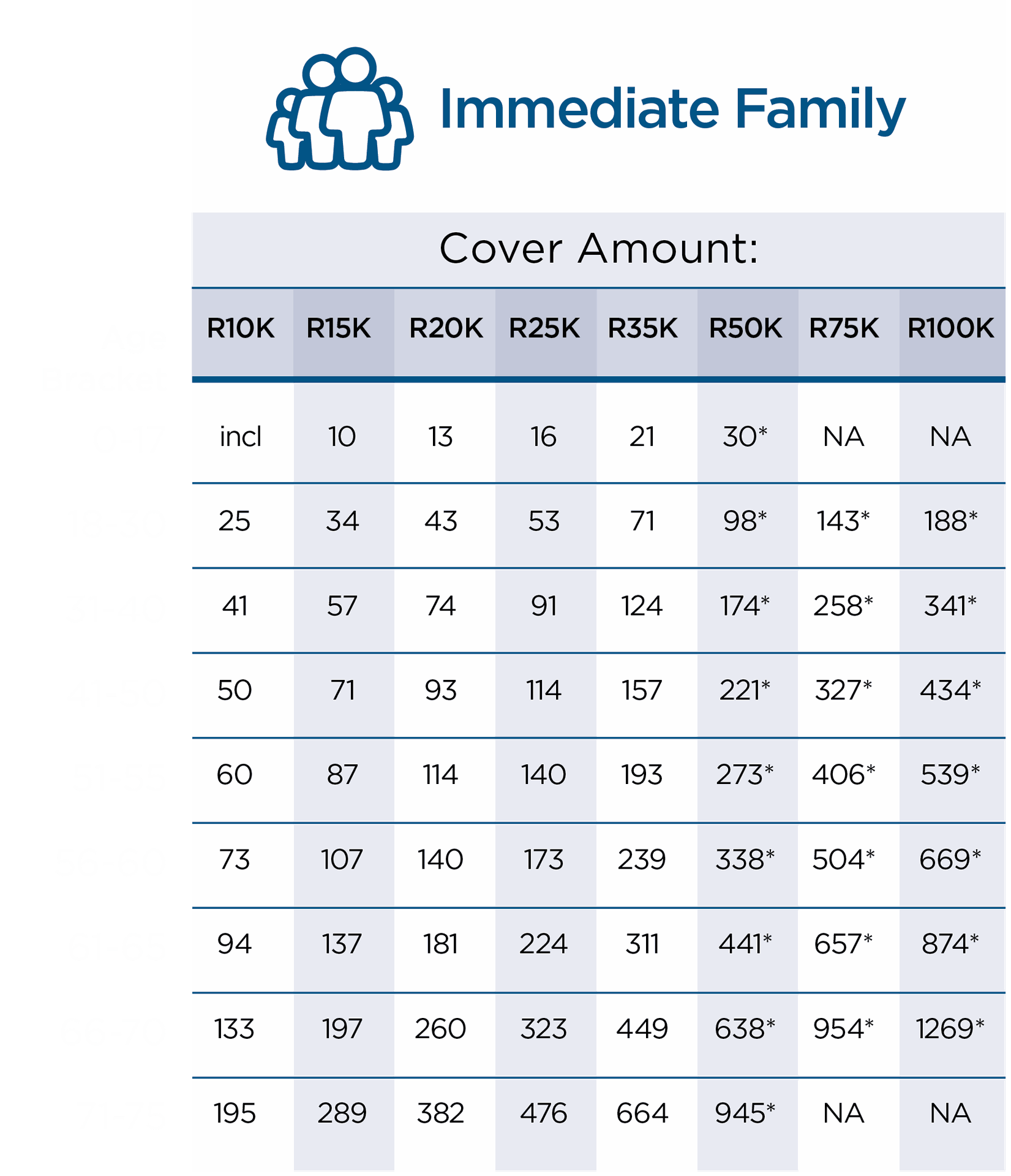

Read moreIMMEDIATE & EXTENDED FAMILY

Cover 2 partners, 4 parents, 5 children and 20 extended family members.

Immediate and extended family can be covered by our Funeral Cover.

Immediate Family

Your Partner

Your Partner

- You can cover up to 2 spouses or partners under the policy, including legally recognised marriages and long-term cohabiting relationships.

Your Child

Your Child

- You can cover up to 5 children, including biological, legally or traditionally adopted, and stepchildren; traditional adoption requires 6 months of cohabitation.

Your Parent

Your Parent

- You can cover up to 4 parents, defined as those who qualify as “mother” or “father” per the “child” description, with coverage based on their age at addition.

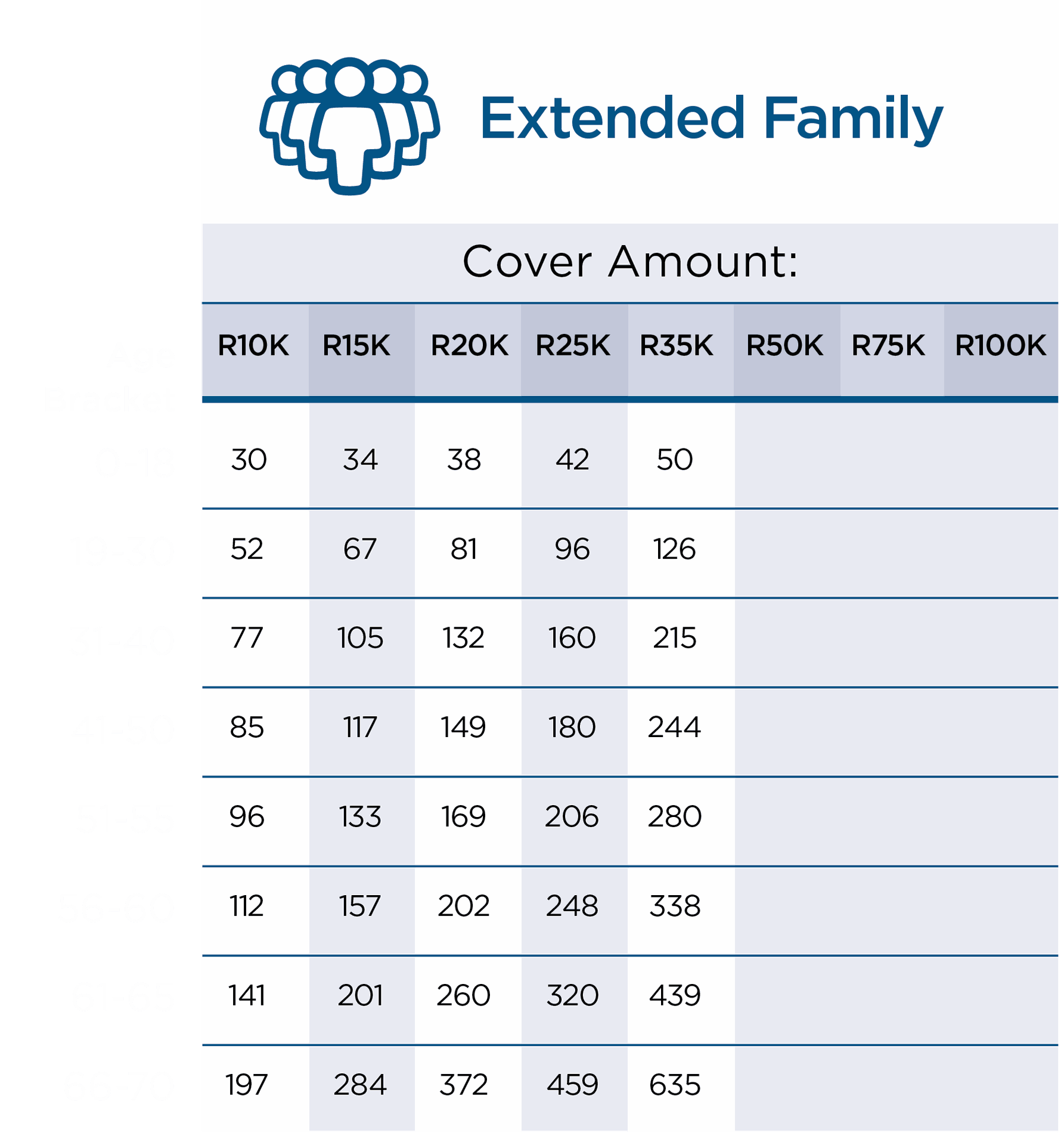

Extended Family

Your brother-in-law and sister-in-law

Your children over 18 year old

Your grandchildren

Your great grandchildren

Your nieces & nephews

Your aunts & uncles

Your grandmother & grandfather

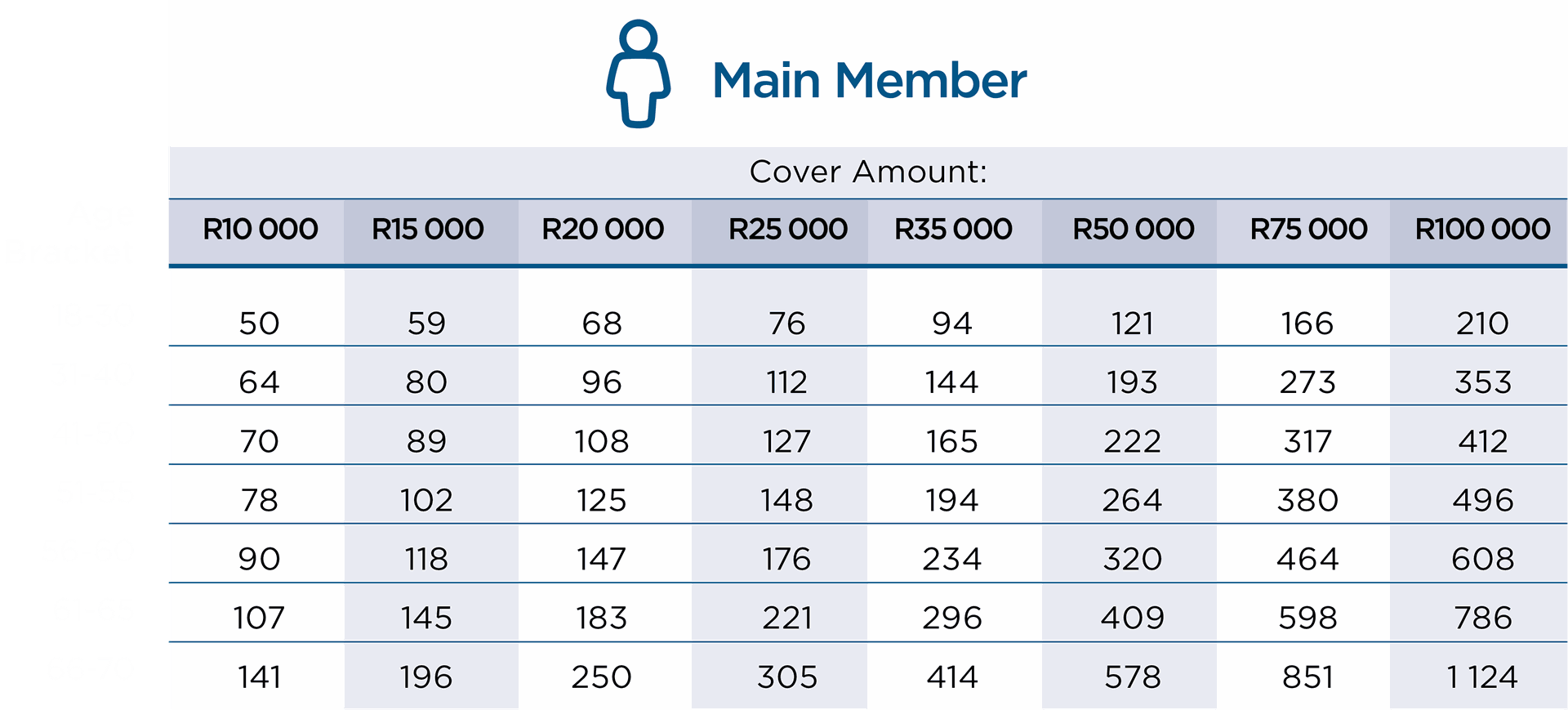

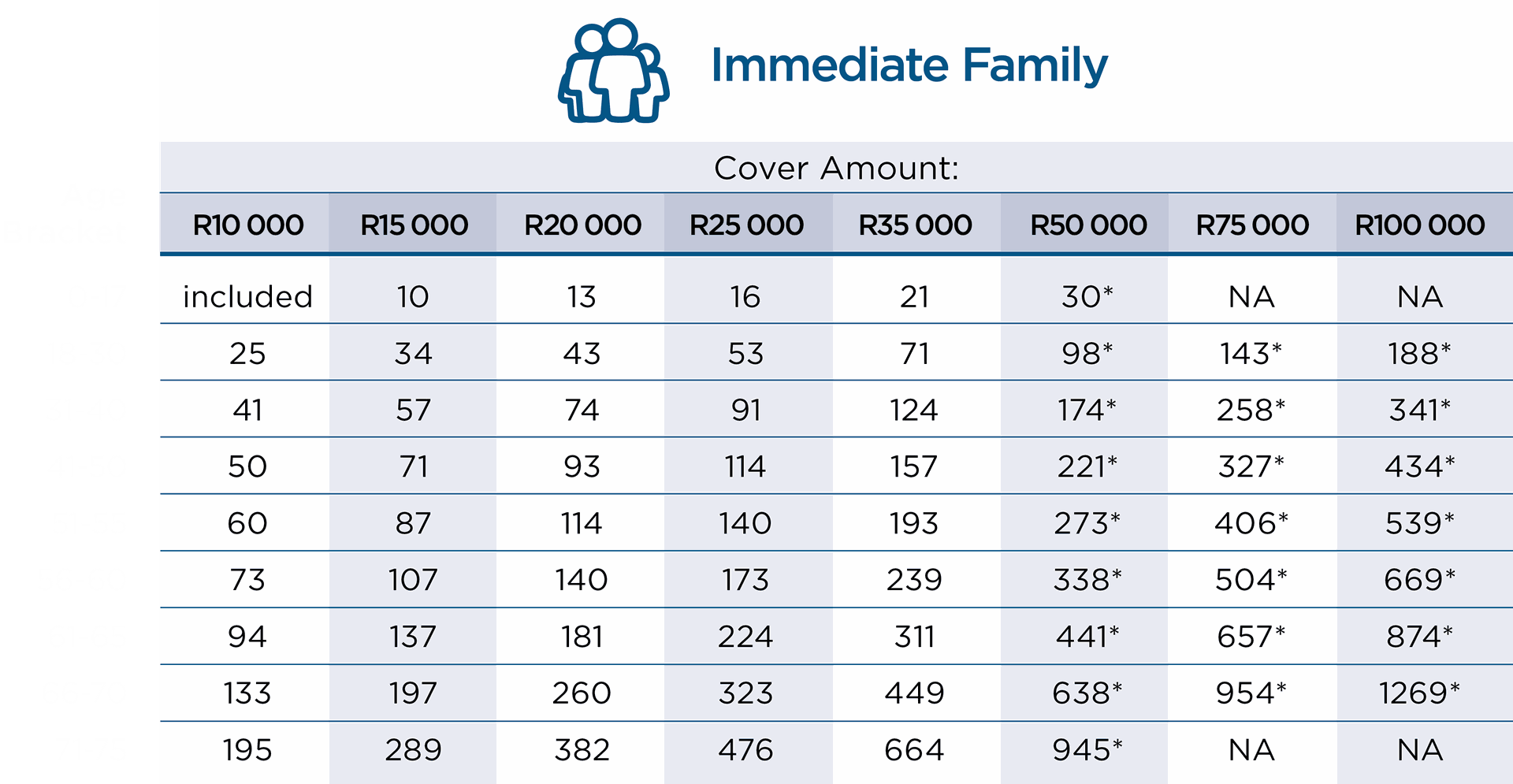

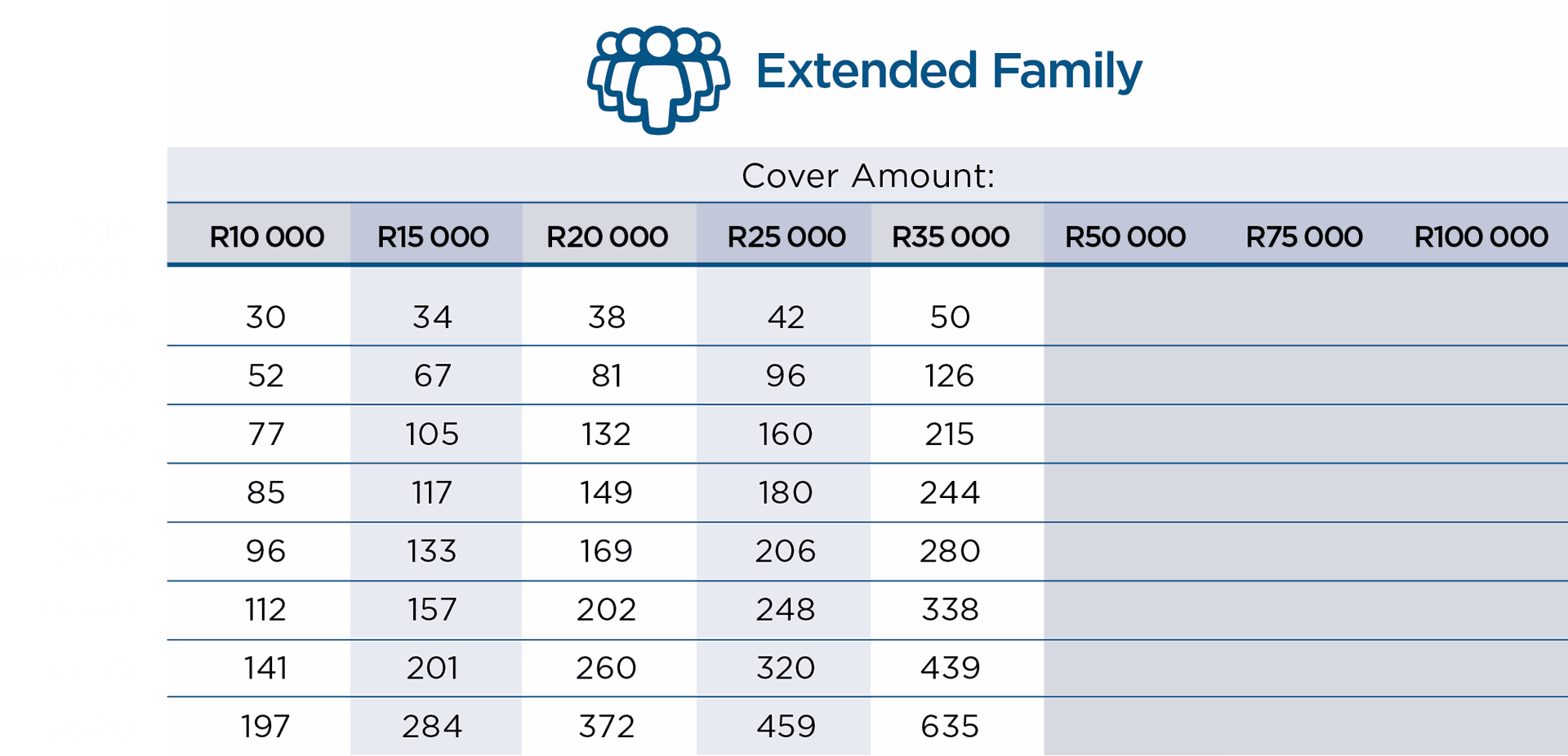

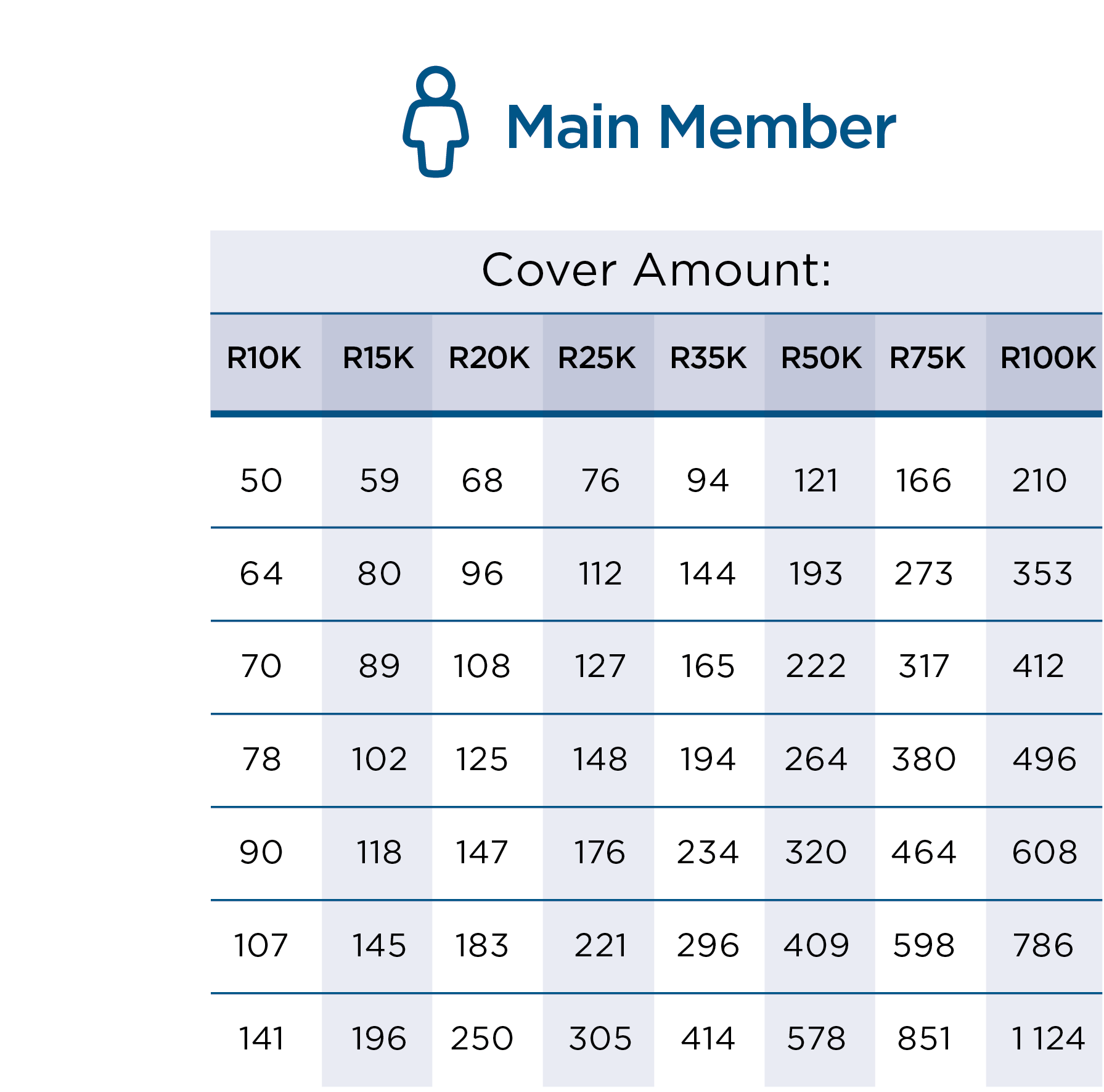

PRICING

Get covered from as little as R50 per month.

Below are the pricing tables for each member type. All prices are quoted in South African Rands.

FAQs

Got questions, let's answer them.

If you can't find the answer your are looking for, please contact us and we will be here to help.

Funeral cover is a type of life insurance that pays out a lump sum of money to help pay for the costs of a funeral. The policyholder pays a premium every month and when a valid claim is made the policy pays out the specified amount on the policy. This payment is usually made to a chosen beneficiary.

The intention of funeral cover is to help pay for the costs of the funeral and provide a dignified burial. However, the payment made for valid claims can be used however the beneficiaries see fit.

At present Asuer Funeral Cover can only be taken up by customers with a South African identity number.

A claim on your Asuer Funeral Cover will not be valid if it made for:

- Suicide in the first 12 months of the policy

- Dishonest or fraudulent claims

- Death as a result of being actively involved in criminal activities

- Active participation in war or riots

Please check your policy wording for the detail on these and other possible exclusions.

Asuer partners with Guardrisk (FSP 76), a licensed life insure, to provide the Asuer Funeral Cover product.

If you want to find out any information or ask for help regarding your policy, you can reach us on:

+27 10 823 7237

hello@asuer.co.za

In addition to providing a lump sum payout to help cover your loved one's funeral, Asuer Funeral Cover offers:

- Cover for for yourself, up to two partners, four parents, five children (under 18), and twenty extended family members - giving you cover for up to 32 people

- Free cover for up to five children under 18

- Lifestage benefits giving you up to six months in premium holidays for significant life events like a birth, marriage or death of the policyholder

- A one-month premium holiday every year after the first year (you get one month at no cost)

Cover amounts range from R10 000 to R100 000, depending on the relationship to the policyholder and your age at the time of entry.

Yes you can. It is highly recommended to supply the ID number as soon as you can to ensure that valid claims get paid out as quickly as possible.

Yes, you can cover up to twenty extended family members including siblings, aunts, uncles, nieces, nephews and grandparents.

You can submit a Claim by using any of the following methods:

+27 10 823 7237

claims@asuer.co.za

You may dispute a repudiated claim within 90 days from the date of the repudiation by providing us with written reasons. We will respond to Your written reasons within 10 (ten) days of receiving these reasons. If your claim is still repudiated you can refer the complaint to the National Financial Ombud Scheme.

The following waiting periods apply:

- Accidental death: no waiting period

- Natural death: 5 months

- Suicide: 12 months

If you are replacing an existing policy you can let us know this during the sales process. We will then take in to account any waiting periods already served at claims stage.

Policyholders must be at least 18 and the maximum entry age is 70. Parents can be covered up to age 75. Children can be covered from birth but will only qualify for free cover until age 18 (they can be added as immediate family thereafter).

Cover ends when either:

- all cover on the policy has been claimed

- the policy is cancelled for whatever reason

- the policy lapses due to premiums not being paid two months in a row

More information on these and other reasons not listed here, please consult the full policy wording.

Premiums are paid every month from a South African bank account via debit order.

No, at this stage only debit orders are accepted for premiums.

Your cover amount will increase by 5% every year to make sure you keep up with rising expenses. As a result your premium will also increase by 5% every year. If we change the premium for any other reason, we will let you know with at least 31 days notice in writing.